Table Of Content

Your lender may charge other fees which have not been factored in this calculation. These results, based on the information provided by you, represent an estimate and you should consult your own financial advisor regarding your particular needs. Experian, TransUnion and Equifax now offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com. Banking services provided by Community Federal Savings Bank, Member FDIC. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there.

Redfin Selling Options

Fairway Mortgage has a positive reputation among consumers, ranking number one for borrower satisfaction by J.D. Plus, the lender offers a few additional loan products that Zillow doesn’t, including USDA loans and reverse mortgages. Only residents of the state of New York are ineligible to take out a mortgage loan from the online lender at this time. Zillow is perhaps best known as an online real estate marketplace. Yet Zillow Home Loans operates as an online mortgage lender as well. It would be remiss of me not to mention an extremely effective way to get your credit score in the best shape possible ahead of mortgage rate shopping.

USDA Loans Minimum Credit Score: 580

Users had an average mortgage balance of $231,194, with an average next monthly payment of $1,632. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Get preapproved for a mortgage before you start house-hunting as well — this will give you a solid idea of your borrowing budget and also make you stand out to sellers. When you’re ready to officially apply for a mortgage, you’re not obligated to go with the lender that preapproved you. You may find that one offers a far more competitive deal than the other, or your credit score needs more work to qualify for better rates.

Credit score versus credit history

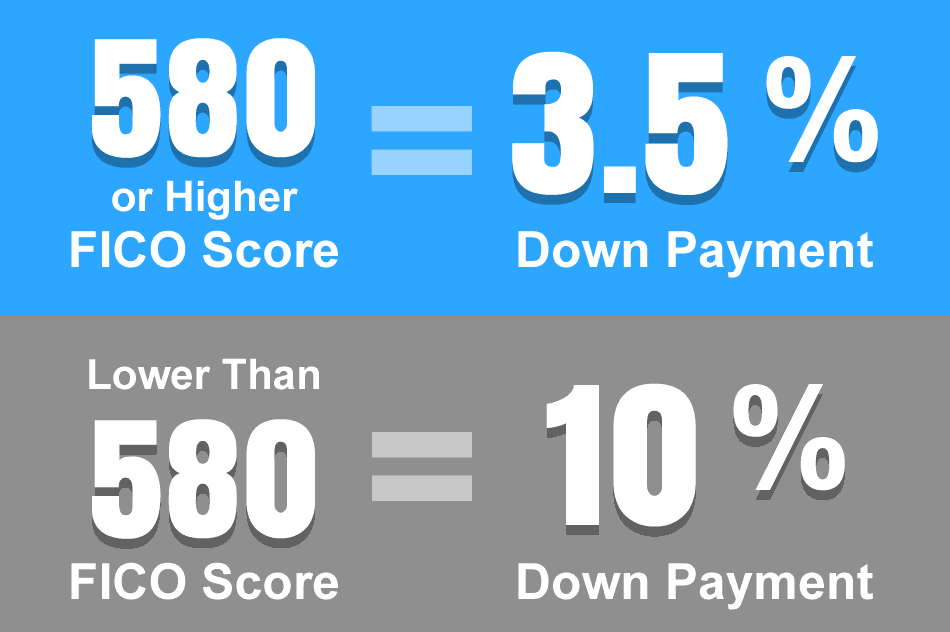

However, FHA loans require both upfront and annual mortgage insurance premiums (MIP). And unlike PMI, which is canceled once you have 20% home equity, MIP is required until you either pay off the loan completely or refinance to a different type of loan. Your debt-to-income ratio (DTI) is the percentage of your gross monthly income that goes toward paying off debt.

Minimum Credit Score for a Mortgage in Canada - NerdWallet

Minimum Credit Score for a Mortgage in Canada.

Posted: Mon, 10 Jul 2023 07:00:00 GMT [source]

VA loans were created for select members of the military community, their spouses and other eligible beneficiaries. Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if you’re likely to pay your future bills – like your mortgage, for example. Your credit score (commonly called a FICO® Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.

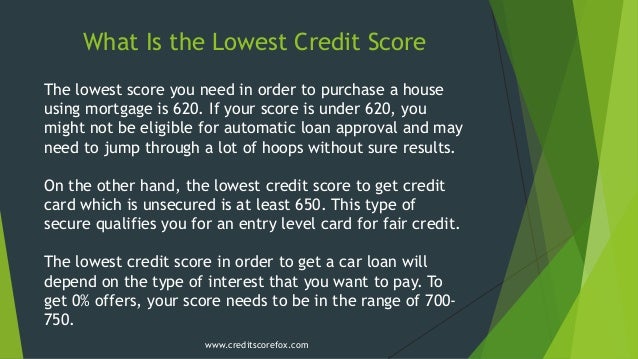

However, it also has some more stringent requirements that don’t apply to conventional loans, such as its minimum property standards. For a conventional loan, the most popular type of mortgage, you'll need a minimum credit score of 620. The purchase price of the home doesn't typically have a direct impact on what credit score you'll need. However, if a higher price leads to you making a small down payment, you may need to have a better score to compensate for that. With a credit score of 620 or higher, you’re eligible for most types of mortgages. However, mortgage lenders consider more than just your credit score.

Check Your Credit Score and Reports

Therefore, it may be a bit more difficult to compare offers from Rocket Mortgage to those from Zillow Home Loans or other mortgage lenders. When you apply for a mortgage with Zillow Home Loan, the online lender will require you to meet certain criteria to qualify for financing. The exact requirements you need to satisfy may vary depending on the specific loan program. Below is a general idea of some of Zillow Home Loans’ minimum borrower requirements. California had an unusually high concentration of cities with Credit Karma mortgage-holders who have higher average credit scores.

Average mortgage balance of Credit Karma members by credit score

Also, avoid applying for any new forms of credit during the months leading up to a mortgage application. This loan type can only be made to eligible veterans, active-duty service members, reservists and surviving spouses. Although the VA has no minimum score requirement, most lenders set their minimum between 580 and 620. That doesn’t mean you can’t get a mortgage with a score below 780.

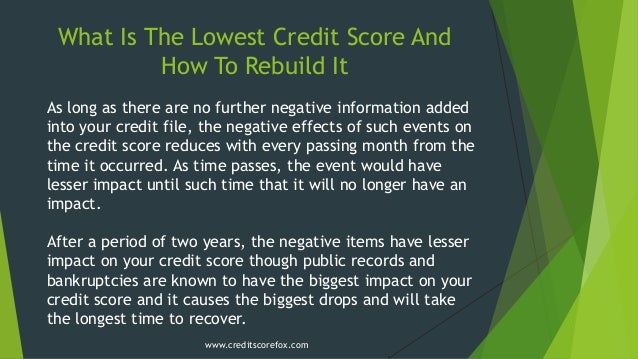

It's best to keep this number (a percentage of how much credit you're using vs. how much you have) below 30%, and it's pretty significant for your FICO® Score, representing 30% of it. (Easy to remember, right?) If you've got a credit limit of $5,000, and carry a balance of $2,000, your credit utilization ratio is 40% -- not ideal. But if your card issuer is willing to add $3,000 to your limit, boosting you to $8,000, you'll have a ratio of 25%. Before applying for a mortgage, you may want to work on your credit scores to help improve your chances of being approved or to better the loan terms you may be offered. It depends on a lot of different factors, but typically higher credit scores make you more likely to qualify for a mortgage and could result in more favorable loan terms.

And if owning your own home improves your overall quality of life, that could be worth paying a little more. They can negatively impact your financial standing even after they’re paid, as paying off a collection upgrades its status to “Paid” but doesn’t remove it from your report. For individuals with bad credit, non-QM loans provide an alternative path to homeownership, albeit with potentially higher costs. Home buyers seeking bad credit home loans have multiple programs to choose from. Yet, the FHA loan stands out as the most common mortgage option for those with poor credit histories.

Different mortgage lenders will view your application differently, so it’s important to shop around when you have bad credit. Online mortgage lenders have opened up more choices for many low-credit-score borrowers. Make sure to work with someone who has a Nationwide Mortgage Licensing System (NMLS) license. That said, it’s crucial to understand the responsibilities and implications for both parties involved. The co-signer’s credit score will be affected, for better or worse, by the loan’s performance. Lenders might also average your credit scores, depending on their specific policies, which can make the loan more attainable.