Table Of Content

Ideally, you'll want to have a credit score of 740 or better if you're getting ready to buy a house, since this will help you get a good mortgage rate. But it's possible to buy a house with a much lower score, particularly if you get an FHA loan, which allows scores down to 580 or even 500 with a large down payment. It's important to point out that your credit score isn't the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause your mortgage approval to fall through. This is your only choice if you’re borrowing above the conforming loan limits, and these loans are more common in expensive cities throughout the country. Most jumbo loan programs require a credit score of at least 700, although there may be programs with lower score limits if you can afford a higher interest rate and payment.

Get mortgage loan preapproval

Surprisingly, some top-tier lenders specialize in assisting borrowers whose credit scores hover around or even dip below 600. Another appealing quality is that, unlike conventional loans, FHA-backed mortgages don’t carry risk-based pricing. Risk-based pricing is a fee added to loan applications with lower credit scores or other less-than-ideal traits.

FHA Loans Minimum Credit Score: 500

Maybe you prefer paying cash over using credit; maybe you’re too young to have a credit history; or perhaps you carry high balances. Your credit score is just one element that goes into a lender’s approval of your mortgage. Here are some other personal factors that lenders consider when qualifying you for a mortgage. Having a higher credit score can save you thousands in interest payments over the life of a mortgage — and help with insurance premiums, too. For more people, their credit score is one of the most important factors in determining whether or not they can buy a home. Lenders lean heavily on your score — which can range from 300 on the low end all the way up to 850 — to decide whether to approve you and what interest rate to offer.

Don’t close older credit lines after paying them off

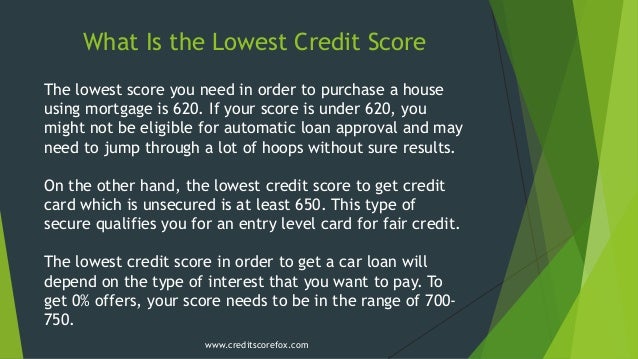

You’ll typically need a credit score of 620 to finance a home purchase. However, some lenders may offer mortgage loans to borrowers with scores as low as 500. Buying a house with bad credit is challenging, but not impossible. Certain types of loans, like FHA loans, are designed for borrowers with lower credit scores. It’s important to first review your credit report, which you can obtain for free from annualcreditreport.com, to understand your financial standing.

"If we suddenly switched off the state pension or significantly reduced it, people would be in trouble, so the government can’t do that. Over the next 50 years, Tom predicts the proportion of GDP the state spends on older people will increase from around 16% to 25%. Rocket Homes Real Estate LLC is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, please contact us at

Today, Zillow Home Loans helps would-be homeowners who are seeking financing for primary homes, vacation homes and investment properties. Existing homeowners who are looking for refinancing options may find solutions from Zillow Home Loans, as well. Plus, you're also taking on untold unpredictable expenses -- if something breaks, it'll be on you to pay to fix it. Owing less money to other creditors and having more space in your budget can help immensely. The table below summarizes generational differences among Credit Karma members with mortgages. This might indicate a general decline of credit health across all consumers over the last two years.

By following these proven steps, you can significantly improve your appeal to lenders and streamline your home buying process. Still, some home buyers can qualify for a home loan with a FICO score as low as 500, depending on the loan program. Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home purchase. Considering the example above, if you take out a $110,000 loan and put $40,000 down ($10,000 more than before), your LTV is now 0.73, or 73%. The loan-to-value ratio (LTV) is another factor used to determine how you qualify for a home loan. There are many ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO®Score and VantageScore® models.

How does a 600 credit score impact how much house I can afford?

This program also requires the buyer to meet certain income criteria and purchase a home in a designated rural area. It’s important to remember that while lenders have minimum credit score requirements, having a higher score can improve your chances of getting a better mortgage deal. Paying down your credit card balances also improves your credit utilization ratio, or the amount of money you spend compared to your total credit limit.

Investment services

These loans often necessitate a 10–20% down payment, incorporating home equity as a key part of the borrowing strategy. FHA loans are known for allowing the lowest credit scores compared to other loan programs, accepting FICO scores of 580 and above, with only a 3.5% down payment required to buy a house. For an FHA loan, you may qualify with a credit score as low as 500 if you can provide a 10% down payment. For a conventional loan, often backed by Fannie Mae and Freddie Mac, a minimum score of 620 is typically required. Different lenders accept different LTV ranges, but it’s best if your ratio is 80% or lower.

Depending on the lender, the credit score requirement ranges from 620 to 640 for 30-year and 15-year fixed-rate loans. Keep in mind that FHA loans are issued by private lenders, and lenders may set minimum credit score requirements. To secure a conventional loan to buy a house, most lenders typically require a minimum credit score of 620. However, the final decision on what works as a qualifying credit score will rest with the lender. Some lenders will let you buy a home with a 620 credit score, and others may require a higher minimum credit score.

Low Income Home Loans For 2024 First-Time Home Buyer - The Mortgage Reports

Low Income Home Loans For 2024 First-Time Home Buyer.

Posted: Thu, 04 Jan 2024 08:00:00 GMT [source]

The more likely you are to pay your bills on time, based on your credit history, the lower your interest rate may be. With a less-than-stellar credit score, however, you may end up paying more. A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible. Be sure to make on-time payments on all your loans and credit cards.

Additionally, borrowers with bad credit may have to go through a more in-depth underwriting process. However, nearly all loans follow this simple step-by-step process. Lenders look at your credit score, DTI, LTV, and assets together to assess your entire financial picture. You may fall short in one area, but can get approved if you are strong in others. For example, if you have a low credit score, you may be required to make a larger down payment, have a greater amount of cash reserves, and have a lower DTI.

No comments:

Post a Comment